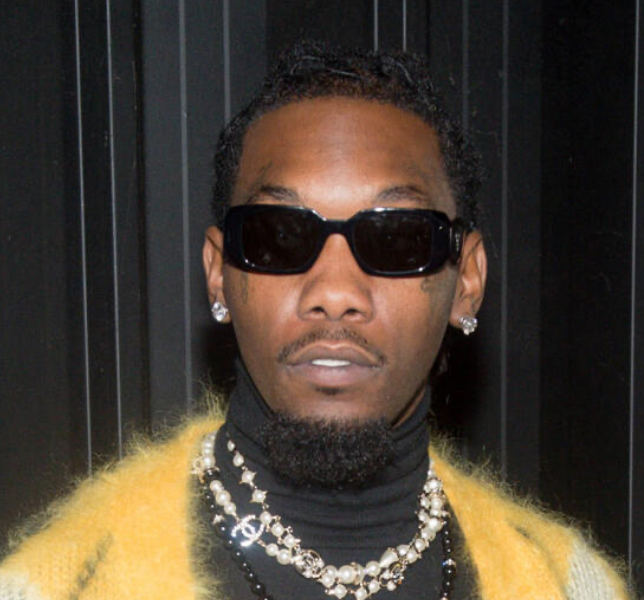

Rapper Offset is facing significant tax debts, reportedly owing over $2.3 million in unpaid federal and state taxes after multiple tax liens were filed against him this year.

What the Reports Show

- According to tax‑records and lien filings, Offset has several tax liens this year: one lien for $486,426.35 for the 2023 tax year, another for roughly $1,575,266.73 for 2022, and a separate claim by the Georgia Department of Revenue for about $292,000 pertaining to 2021 (including interest and penalties).

- At least three federal tax liens have been filed against him in 2025, signalling the IRS’s escalated collection efforts.

- These tax issues surface amid his ongoing divorce from Cardi B and other financial/legal pressures, adding to the rapper’s overall financial stress.

Why This Is Significant

- Owing millions in unpaid taxes can lead to serious consequences: property liens, wage garnishments, frozen assets, and even criminal tax charges if willfulness is found.

- For Offset — already a high‑profile artist, brand partner and member of the streaming era’s lucrative class — this level of tax trouble could damage his reputation and future earnings.

- The timing is especially risky: filing issues, marital separation, and public scrutiny all compound the financial instability and legal exposure.

- Music industry watchers will be watching how this impacts Offset’s upcoming releases, touring schedule, endorsements, and ability to negotiate in business partnerships.

What to Watch Next

- Whether Offset settles the IRS and state tax claims, or attempts to negotiate an installment agreement or offer‑in‑compromise with the taxing authorities.

- Any public statement from Offset’s team addressing how he plans to rectify the debt or explaining circumstances behind the non‑payment.

- Whether the IRS or Georgia tax authorities will take further action: lien foreclosure, asset seizure, or referral to criminal investigation.

- How this will factor into his financial disclosures in the divorce proceeding with Cardi B and whether marital assets will be affected by the tax liabilities.

0 Comments